views

Building a Balance Sheet

Understand the basics of the balance sheet. The balance sheet is called so because it shows the company's balance between assets and liabilities. The key underlying basis of the balance sheet is the basic accounting equation, which is Total Assets = Liabilities + Shareholder’s Equity {\displaystyle {\text{Total Assets}}={\text{Liabilities}}+{\text{Shareholder’s Equity}}} {\text{Total Assets}}={\text{Liabilities}}+{\text{Shareholder’s Equity}}. Rearranging the equation, you can see that equity is equal to assets minus liabilities. The balance sheet reflects this relationship. All assets and liabilities are listed and added up on the balance sheet, then liabilities are subtracted from assets to arrive at a figure for shareholder's equity. Balance sheets may be constructed using accounting software. Or, you can simply create a spreadsheet or written list with two columns that can be used to total your assets and liabilities by category.

Determine your assets. Your assets are anything that you own, including the cash you have on hand. Assets usually divided into "current assets" and "fixed assets." Your current assets include the cash you have on hand and what could be liquidated quickly, usually within a year. In this category, you would have things like your accounts receivable (what people owe your company), any securities becoming due with a year such as bonds or savings accounts, and your inventory. It can also include pre-payments or deposits you've made ahead of time, such as insurance for the next year. Fixed assets are tangible and known as property, plant, and equipment. These are assets with a useful life in excess of one year. There are also intangible assets that may be held on a balance sheet. These include patents, brand recognition, and copyrights, along with other non-physical assets. All of these assets need actual dollar figures in your balance sheet, these can be calculated exactly or estimated based on (and in compliance with) industry convention.

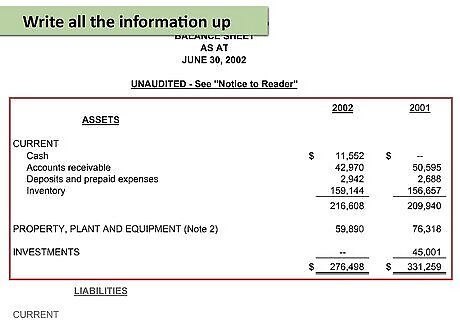

Write all the information up. To write the balance sheet, you need to lay this information out in detail. That is, you need to label each asset along with the dollar amount, divided into current and fixed assets. Add all of your assets up into a total.

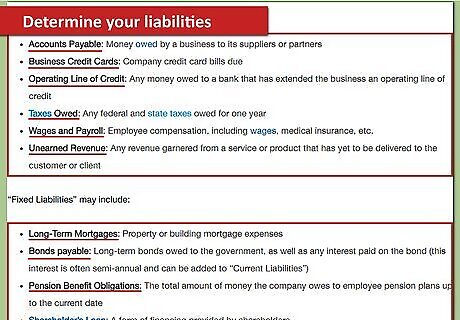

Determine your liabilities. Your liabilities are what the company owes or has paid to other companies or people, including employees. In other words, it's the company's debt. These assets are also divided into "current" and "long-term" categories. Current liabilities include things like what you owe on lines of credit and credit cards, as well as anything owed to other companies for goods and supplies. It also includes the income and wages you've paid out to employees and taxes owed, along with unpaid rent and utilities. Long-term liabilities include long-term loans payable, bonds payable, and other liabilities that will be paid out over a time period longer than one year.

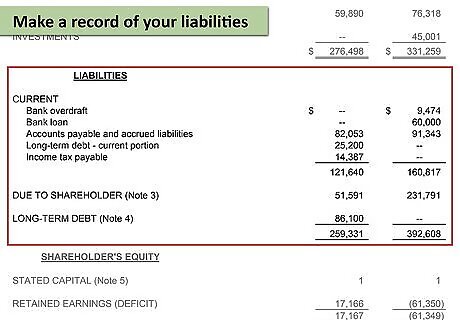

Make a record of your liabilities. Just like your assets, you need to account for each liability (in major categories, such as loans, mortgages, and so on). Also, divide your liabilities on your balance sheet into current and long-term. List liabilities by category and include the value of each category next to the its name. Add up all your liabilities to get your total.

Subtract your liabilities from your assets. To figure out the shareholder's equity (also called shareholder's equity), you subtract what is owed from what assets you have. A positive amount of equity indicates that the company has financed its operations with its own money or that of investors, rather than relying as strongly on debt. Have a line for your total assets. Below it, have a line for your total liabilities. Show what the shareholder's equity is when you subtract the second from the first.

Expand on shareholder's equity. On your sheet, have a section where you show what the shareholder's equity is. This section will include items that represent the shareholder's interests in the company. For example, common stock, preferred stock, capital in excess of par, and retained earnings are all common shareholder's equity categories. When you've listed these categories out, sum them up to arrive at total shareholder's equity. Compare your total to the difference between assets and liabilities from your earlier calculations. If the figures don't match, either you or the accountant that keeps the company's books has made a mistake somewhere along the way. Many balance sheets are organized such that the assets are totaled on the left and liabilities and shareholder's equity are totaled on the right. This provides a more literal representation of the basic accounting equation.

Writing the Income Statement

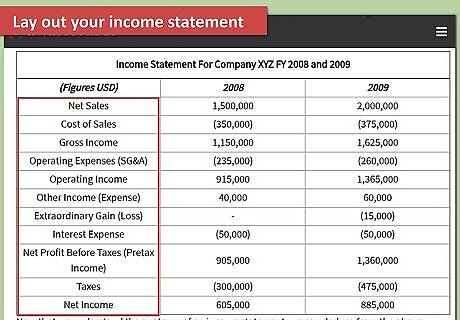

Start with net sales. As a general rule, the first figure listed in a company's balance sheet is net sales for the period in question. The income statement may just say "sales" or "revenue," but the figure used is net sales. Net sales represent the gross sales (total sales in the period) minus any returns, discounts, or allowance for lost or damaged goods. This is the company's "top line" and is the truest representation of sales over the period. Unlike the balance sheet, the income statement covers financial activity throughout the period in question, whether that is a month, a quarter, or a year. The income statement is organized as a reduction of net sales by various expenses faced by the company to arrive at net income (also called net profit or the bottom line).

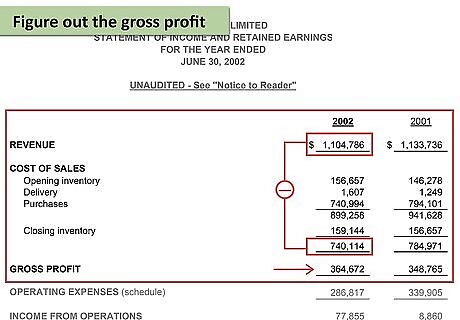

Calculate gross profit. Your first calculation on the income statement will be that for gross profit. Gross profit represents the company's profit after considering the cost of goods sold (or services provided/sales). Cost of goods sold includes the cost of all materials and labor that went directly towards producing the products that were sold over the period. Total this amount and subtract it from net sales to arrive at gross profit.

List the company's operating expenses. On the balance sheet, expenses are separated into two major categories: operating and non-operating expenses. Operating expenses follow the same philosophy as the cost of goods sold. That is, they are those expenses related directly to the operations of the company. This includes the cost of selling and advertising products, administrative costs, and wages for employees involved in these departments. It also includes general expenses, such as utilities, rent, and manager salaries. Remember that materials and manufacturing labor costs were already covered in the cost of goods sold and do not need to be counted here. Separate these expenses into three major categories: selling, general and administrative expenses. When you've written out the amount of each expense, total them to find total operating expenses. Subtract total operating expenses from gross profit to arrive at operating income.

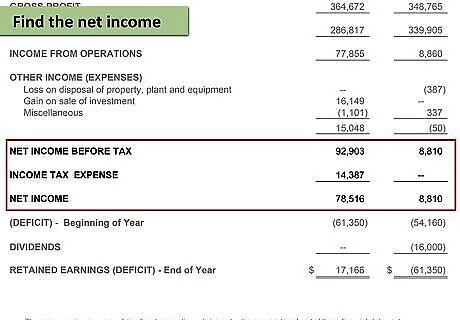

Write out non-operating expenses. The other category of expenses on the income statement, non-operating expenses, are those expenses that are not directly related to operations. These include interest, amortization, depreciation, and tax expenses. There is also room in this section to record an "extraordinary gain or loss," which might arise from a massive amount of inventory theft, for example.

Lay out your income statement. As you go, lay out each piece of your income statement. Net sales will be at the top. Each piece will follow in sequential order. Put the net sales on one line. Underneath that, put the cost of sales. Below that, subtract the cost of sales from the net sales to get the gross profit. Skip a line before moving on to operating costs. Put the operating costs in general categories underneath the gross profit. Generally, selling, general, and administrative costs are lumped into one, but not always. Underneath that, write the operating income that you derived from subtracting the operating costs from the gross profit. Next, have a line each for the interest and the taxes. You can subtract them separately or together. Separately gives you more precise data. The final line should be the net income.

Writing the Statement of Cash Flows

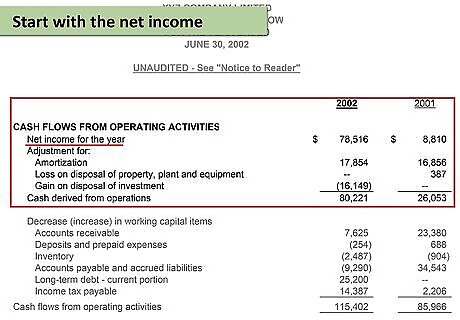

Start with net income. The cash flow is an essential number to the company because it establishes the actual cash you have on hand. It's different from your income because your income includes non-cash expenses and assets that do not affect your actual cash balance. However, in order to create a statement of cash flows, you will first need a completed income statement and completed balance sheets from this period and the previous period. The statement of cash flows is split into three pieces: cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.

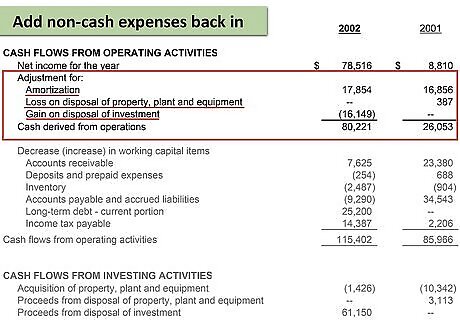

Begin calculating cash flows from operating activities. With operations, you're looking at how much operations bring in through cash. This step is different from what you did in your other statements because those statements include non-cash items. Here, you are focusing solely on cash. In other words, you must add some things back into the net income because they weren't really cash expenses, and therefore, won't affect the money you have to work with right now. Start with non-cash items, things like amortization and depreciation. Amortization is when the company spreads out the cost of something over time for accounting purposes. However, it is not really a cost taking away from cash flow right now. Therefore, you add that expense back in. The same with depreciation. It's a number taken away from the total amount of an asset, as it loses value over time. However, it's not technically a cash flow problem, so that expense is added back in. This method is the indirect method of figuring out cash flow. The direct method involves adding up cash flows from scratch rather than starting with net income.

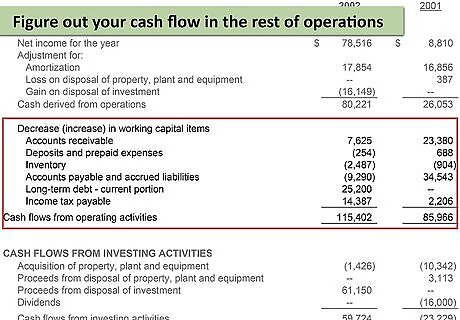

Figure out your cash flow in the rest of operations. Now you need to look at other items that bring in or take out cash through operations. For instance, gains or losses on sales of fixed assets are included in this category, as this activity brings in (or draws out) cash. If you have sold fixed assets within the period, such as property, you need to look at whether it was a gain or loss, then add or subtract it from the operating costs. You also need to look at changes in accounts receivable. Since accounts receivable is what other people owe the company if it goes down, that means the company has gained cash, and that needs to be added in. On the other hand, if the company has bought inventory, that signals a decrease in cash and needs to be subtracted from the cash flow. Other items that can affect the cash flow include taxes payable, insurance you've already paid, and salaries payable.

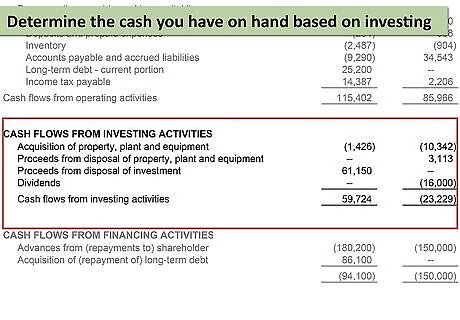

Determine cash flows from investing activities. Like with operations, you need to examine how investing has affected your overall cash flow. This category is focused on long-term investments, such as equipment and buildings. This category mainly focuses on where cash has gone in the current year when it has been invested. This step can include money you've put into new equipment or other capital, such as buildings, which will be subtracted from cash flow. It can also be equipment you've sold, which would be added to the cash flow. This step also includes any money invested in the stock market, what you've bought and sold, and how that affects your overall cash.

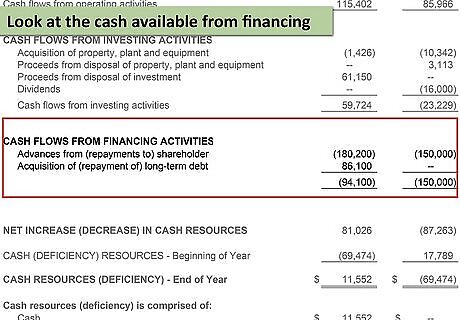

Look at the cash available from financing. The third category is financing. This section is focused on the money that is used to finance your business, such as loans. It also has to do with stock options and shareholders, and how that affects cash flow. Loans are added to your overall cash. However, your loan payments for the year are taken out of the overall cash. Dividends you pay out to shareholders obviously reduces your cash, while if you issue bonds or common stock, the issue is recorded as an influx of cash.

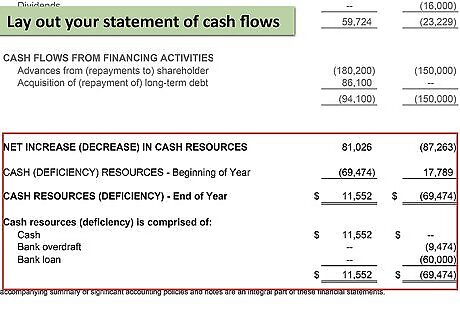

Lay out your statement of cash flows. Start with the net income at the top, and move down through the three categories. It's best to keep the three categories separate, as then people reading the statement of cash flows can see where expenses are going in and out. Subtract and add cash as needed in each category, to reach your net increase or deficiency in cash for the year. Add in last year's cash. If you have any cash left over from last year or you started out with a deficit, add that or subtract that to this year's cash. That will give you the total amount of cash you have on hand, also called your total cash resources.

Comments

0 comment