views

Being an adult is not an easy task; along with responsibility comes a plethora of bills that needs to be paid. But imagine the horror of waking up to 580 brown envelopes of bills flooding your doorstep. Dylan Davies wouldn’t have ever imagined he will receive tax bills from 11,000 foreign companies that he has zero connection with. According to a report by BBC, multiple Chinese companies used Davies’ Cardiff flat address to register themselves with HMRC (HM Revenue and Customs), the UK governing body responsible for tax collection.

Reportedly, the firms fraudulently used the address to pay VAT (Valued added tax). The overall debt is estimated to be £500,000 (approximately Rs 5 crore). During his interaction with the news agency, Davies revealed that the error was not even picked by the HMRC’s internet systems. “It’s been horrendous. You’d think there’d be a system with the technology today that would have picked it up immediately,” he said.

Dylan Davies further said that HMRC needed to “tighten up completely,” adding that it was easier to “register a company for VAT than it is to go and get a bus pass.”

Even after the error was highlighted from the British man’s end, the bills kept arriving in his mail. But the problem became worse when the letter began coming from debt collection agencies. Davies reportedly lived in fear that collectors might raid his home or worse might get hold of his possessions making him homeless. He vividly recalled imagining people breaking down his door to seize his TV.

In a statement by Jim Harra, the permanent secretary at the HMRC, confirmed that out of the 11,000 companies, 2,356 registered at Davies’ address owed money to the department. Harra also highlighted that the government body has acknowledged Davies’ situation by putting a system that will now stop the bill letters from reaching his doorstep. He asserted that the investigation in the matter continues but so far they haven’t found any evidence of ‘fraud or fraudulent intent.’

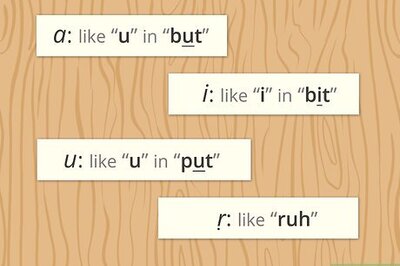

The report suggests that a change in law back in 2021 made it mandatory for online marketplaces to collect VAT from international traders and pay it to the HMRC. But the law doesn’t apply if a company is registered to a UK address. A financial crime consultant Graham Barrow reportedly finds the incident related to VAT fraud. He believes that online marketplaces might be procuring VAT from overseas trader but aren’t paying it to the HMRC.

Read all the Latest Buzz News here

Comments

0 comment