views

The concept of fiscal deficit was first mooted in the Economic Survey of 1989-90. Since then, it has become a key parameter to measure the fiscal performance of the government. It is the difference between what the government collects via total taxes and non debt capital receipts and what the government spends during the year. Fiscal deficit has been a serious issue for the country since its inception. The average growth of the fiscal deficit during the 1990s was 10 per cent. Therefore, the government enacted FRBM Act 2003 and set a combined target for the centre and state deficit to reduce to 2.5 per cent by FY23. However, the target has never been achieved and has been changed a number of times through the finance bill.

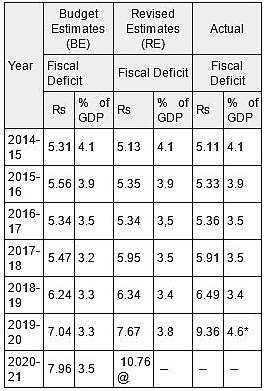

In the last budget, the government revised the target to 3.8 per cent for FY20, 3.5 per cent for FY21, 3.3 per cent for FY22 and 3.1 per cent for FY23. Now under the shade of coronavirus, the government would have to further review the FRBM. It has reached 4.6 per cent of the GDP in FY20 due to poor revenue realisation. It is the highest since the last seven years. As per the CGA, the fiscal deficit stood at Rs 9.36 lakh crore against the revised estimate of Rs 7.67 lakh crore and Rs 7.04 lakh crore of budget estimate in FY20.

During Covid situation, the deficit became the headline of mainstream media. The coronavirus pandemic has been disruptive in terms of economic activity in the present fiscal year. The government has raised its gross market borrowing target from Rs 7.8 lakh crore to 12 lakh crore. It is 5.8 per cent of GDP. The government is forced to borrow more because there is a huge decline in tax and non-tax revenues for the government. On the other hand, there is a massive jump in the public spending. SBI has estimated that the revenue will decline by Rs 3.2 lakh crore and expenditure will rise by around Rs 3.3 lakh crore.

As a result, the gap between revenue and expenditure has risen. It is expected that the fiscal deficit will be 7-8 per cent of the GDP in the current fiscal year against the budgeted target of 3.5 per cent. As per the CGA, the fiscal deficit stood at Rs 10.76 lakh crore upto November against full year budget target of Rs 7.96 lakh crore for FY21. It is 35.1 per cent higher than the budget estimate and 14.8 per cent higher than the corresponding period of previous year. Now, what will be the size of the full year fiscal deficit? None would be able to answer. However, as per the analysis of SBI, the complete deficit will be Rs 14.46 lakh crore.

The rating agencies and financial institutions have their own estimates of deficit for FY21. While SBI pegged the FY21 deficit at 7.4 per cent of the GDP, HDFC bank kept it at 7.6 per cent, ICRA and DBS put it at 7.5 per cent, India Ratings and Barclays forecast it at 7 per cent, and Care rating estimates it at 9 per cent. It will be a difficult task for the finance minister to set a target for the fiscal year 2022. Nevertheless, SBI pegged it at 5.22 per cent for FY22. The table shows the budgeted estimate, revised estimate and actual data of fiscal deficit and GDP since 2014.

The government must push-up expenditure, especially in infrastructure and MSME to create demand in the marker. To bridge the gap of revenue-expenditure, it is the right time to simplify goods and services tax to increase tax net. Subsequently, speeding-up of the process of disinvestment of state-owned-enterprises and monetisation of assets to increase non-tax revenue.

Now, it is crystal clear that we are not going to keep the deficit below 4 per cent in the next three to four fiscal years. It is very difficult for the government to aim for 3 percent in the present situation. The need of the hour is to draw a new roadmap for fiscal consolidation and accordingly change the target of deficit by the finance bill 2021.

The author teaches Finance at I.T.S Ghaziabad. He is the co-author of recently published book – Indirect Tax Reform in India: 1947 to GST and Beyond. Twitter @meetdrvinay. Views are personal.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment