views

Indian stock market indices plunged sharply on Friday morning to hit their lowest levels for the year 2020. At 9:44 am, the benchmark BSE Sensex was trading down 1,031.60 points, or 2.68%, to 37,439.01, while the Nifty 50 fell below the crucial 11,000-mark, trading at 10,956.10, down 312.90 points, or 2.78%.

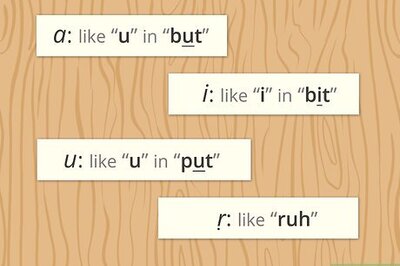

The Indian rupee also weakened sharply in early trade, opening down by 61 paise at 73.94 per dollar versus its previous close 73.33.

Asian shares took a beating on Friday following another session of selloff on Wall Street as disruptions to global business from the coronavirus beyond China worsened, stoking fears of a prolonged world economic slowdown.

Besides coronavirus fears, the markets were also taken aback by the Reserve Bank of India’s (RBI’s) action on Yes Bank Ltd, India’s fifth largest private lender. The central government on Thursday evening imposed a moratorium on Yes Bank effective 5 March, restricting the withdrawal of deposits to Rs 50,000 per customer. Consequently, the Yes Bank stock plunged 25% to Rs 27.60 in early trade.

Meanwhile, State Bank of India (SBI) shares also lost as much as 12% on reports that the public sector bank and the Life Insurance Corporation of India (LIC) are set to pick up a total of 49% stake in Yes Bank as part of the government’s rescue plan for the private lender.

Along with SBI, shares of other state-run banks also dropped after eight of them announced share swap ratios for the proposed mega merger of PSU banks. The Nifty PSU Bank index was down 5% in early trade.

Cola India, TCS, Tech Mahindra, Tata Motors, RIL and ICICI Bank were among some other major losers among the Nifty 50 stocks.

All sectoral indices were trading in the red, with the Banking and Metal indices being the biggest losers (down 4.1% each), followed by realty, auto and capital goods indices (down 3-4% each).

Comments

0 comment